Banking and Financial Services

Smart Transformation for Banks

TALANG's Financial Services (FS) encompassing both Banking and Financial Services employs many years of our experience to support clients who envision it as a business enabler. Added to this, TALANGS achieves its core strength in the FS area from its parent company, EVRY Group, which maintains No. 1 position as an IT solutions provider for the Banking & Finance sector in the Nordic Region, having more than 200 customers, coupled with a comprehensive set of banking services and solutions that serve in excess of 10 million end customers.

As an IT service provider, TALANG's constant endeavor is to raise the bar to leverage expertise to the customers’ advantage. Our vast knowledge base ensures that our learning curve is short and the benefits to the customer accrue early in the engagement cycle. Our stable resource pool ensures minimal deviations from planned business programs. We have the experience of partnering with some of the leading players in the BFS industry to help them address their business needs by way of providing innovative solutions powered by our deep domain and technological expertise.

-

Functional Focus

We have served numerous highly satisfied customers including banks, financial institutions and other independent software vendors, who have appreciated the value and focus on delivery that TALANGS brings to the relationship.

-

Customer Access

TALANGS specializes in easing customer access across several banking transactions. We are involved in various channel solution implementations for our customers across Europe and the US.

-

Internal Services

TALANGS has undertaken effective engagements in the Internal Services space that have benefited the customers profitably.

-

Enterprise Services

TALANGS has been involved in delivering some high-end solutions to its customers in the Enterprise Services space.

The Banking and Financial Services industry is one of the key focus areas for TALANGS. We have served numerous highly satisfied customers including banks, financial institutions and other independent software vendors, who have appreciated the value and focus on delivery that TALANGS brings to the relationship.

In this space, TALANGS has maintained a focused approach of strengthening our key competency areas while bringing in new functional areas into focus as well. Cards and Payments has been a strong focus area for TALANGS over the years with multiple customers and assignments dotting the landscape. Retail and Corporate banking has also been in focus, where we are involved in some strategic re-engineering projects and platform enhancements for different customers. TALANGS also carries out successful deliveries in the Investments and Securities space, with special focus on investments & portfolio management and investment analytics.

We believe that to succeed in this industry, the ability to understand and relate to the business of the customer is the most important necessity. This belief has resulted in the establishment of the BFS Academy, an internal training and certification program that enables technologists by helping them understand the basics and key focus areas in their domains. It is also our constant endeavor to enable our horizontals such as Testing, BI / DW and Mobility to appreciate the domain point of view, so that the solutions they design for our banking and financial services customers are aptly thought out and shaped. This helps us in being a ‘Learning Organization’.

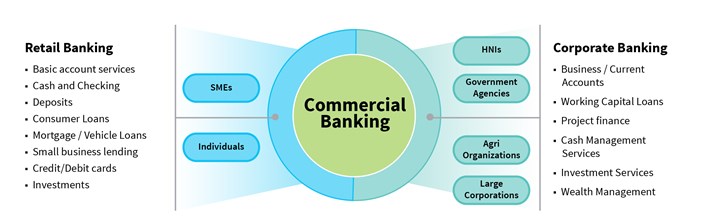

Retail banking targets on being a one-stop financing solution for several banking services for retail clients. Increasing customer demand for versatile products, coupled with exceptional customer service has become a greater challenge. The need to be abreast technologically is also a necessity to provide better services to the customer. Customers of corporate banking can be from different business segments, like small, mid and large sized companies. Each business segment has different needs starting from cash and overdraft facilities to syndication and securitization. Banks also need to maintain the corporate customers’ data, commercial loans and corporate deposits and even have to extend various liquidity management facilities for their privileged customers.

TALANGS helps its clients strategize the transformation of their banking solutions resulting in improved operations and services, in turn improving the overall business performance. We have the following implementations to our credit:

- Re-engineering and support of the leading core banking platform in the Nordics

- Delivering a farm credit lending application for a prominent farm credit bank in the USA

- Implementing a liquidity management solution for a major Nordics bank

- Developing the internet banking portal for a top Scandinavian bank

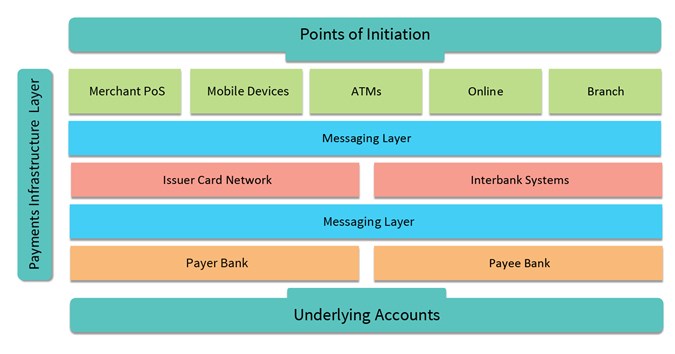

The global payments landscape is rapidly advancing technologically. Conventional payment methods have given way to the state-of-the-art online payment infrastructures that offer speed, efficiency, accuracy and utmost security, enabling businesses and financial institutions to facilitate both domestic and international payments and settlements with relative ease. Cards are popular with users and, banks have, over the years, devised innovative strategies around their card-related offerings to retain and grow their customer base. Banks constantly innovate to provide this newest channel to customers with newer options in order to retain and grow their base.

TALANGS has the experience of having led many customers to modernize their payments and cards infrastructure and also to become compliant with incessantly emerging regulations. We have developed:

- SEPA-compliant payments solution for a customer in the Nordics

- Electronic payments system with Check 21 capabilities for an ACH service provider in the USA

- Invoicing and billing solution for one of the largest banks in the USA

- Merchant monitoring and fraud prevention application for a European bank

- Card issuing sub-system as a part of online banking for a Scandinavian bank

- PCI-DSS compliance readiness assessment performance for leading banks in Europe

- System for pre-paid Forex cards for a major Scandinavian bank

The challenges faced by the key players in the industry today are multifold, from immense regulatory pressures to market volatility caused by the debt crisis, to eroding the trust of customers and technological challenges. The buy and sell firms, both realize that they need a reliable technology today, more than ever, in order to successfully meet these challenges and navigate the rough waters.

Advanced trading systems with sophisticated algorithms, robust middle office infrastructure with reliable reference data systems, and a strong clearing and settlement framework have helped these firms to stay afloat and continue to provide innovative financial products and services to their customers.

TALANGS has successfully executed the below stated assignments in the Investments and Securities space:

- Co-developed a hedge fund application with a leading US-based solutions provider

- Developed a customer portal for trading, pensions and investments for a chief Nordics bank

TALANGS specializes in easing customer access across several banking transactions. Our customer-centric focus in the banking and financial services segment and our commitment extends to fulfilling the long term needs of our customers. We are involved in various channel solution implementations for our customers across Europe and the US. TALANGS has successfully re-engineered a core banking platform in the Nordics, developing an internet banking solution for a leading bank in Scandinavia, developing a mobile banking app for a large farm credit bank in the US, and is also engaged in delivering online payment solutions featuring a mobile interface for a large auto retailer.

Whether it is Branch Banking, ATMs, Internet Banking or Mobile Banking, TALANGS maintains multi-channel expertise that extends towards building versatile banking applications. We have successfully developed technologically advanced internet banking portals that provide retail and corporate customers with a broad spectrum of services.

- Branch Banking

Financial institutions have traditionally been on the lookout for newer ways of reaching out to their customers, and realize that, for them to be able to retain customers and grow revenues, they need to prioritize top-notch customer services, regardless of the point of contact. The branch remains a key component in this endeavor and it is imperative for branch employees to have the appropriate technology to empower them to know, understand and service their customers' unique needs.

TALANG's banking solution focuses on customer needs at the forefront of its design considerations, so that customers can avail a wide array of full-service banking. We believe that evolving the branch banking strategy and aligning it with the ever changing consumer realities will help banks increase their return on investment and position themselves strategically for the future. Managing bank branches in a smart way and providing utmost customer convenience with easy financing, makes branch banking needful even in the future, even with traditional / personalized services.

- ATMs

Alternative channels such as the ATM help banks enhance the customer experience whilst also helping to reduce the total cost of service delivery. ATMs have gradually grown from being just cash dispensers to being able to offer a whole plethora of services from cash/check deposits, money transfer, currency exchange, bill payments, cellular phone services such as prepaid top-up and information, ticketing for events, etc.

Further, in the process, increasing customer convenience and providing expanded business opportunities for bank ATM operators to offer speedy and convenient banking alternatives to customers is the focal point of TALANG's banking solution. Our solution focuses on ease of use and convenience that simplifies every transaction to a large extent. Our aim is to make banking easier and quicker than ever for account holders from multiple locations, so that one can bank conveniently and manage banking needs from anywhere.

- Internet Banking

Internet banking is one of the biggest game-changers for banks that, most of the banks have started operating 100% online with no physical branches at all. Today, there is almost no service that cannot be offered online – from basic account opening and servicing, to fund transfers, utility bill payments, cards and loans and even investment advisory services – everything is available at the click of a button. And, most important of all, customers have embraced this form of banking, which has encouraged banks to make higher investments to develop this channel even further.

TALANGS recognizes how important online banking is for customers, and hence, we provide solutions that give them the options to bank securely. As security and convenience form the basic parts of Internet banking, our banking solutions help you manage your personal financing and transactions as intended in order to enhance your banking experience. Our banking solutions help you manage your money the way it suits your needs.

- Mobile Banking

Banks recognize that mobile banking is the next logical step ahead in the banking technology, with smartphones and tablets being widely in use. Mobile banking profoundly helps easing financial services solutions on mobile. The global mobile banking industry is expected to grow exponentially with time. Mobile banking surely simplifies advanced banking operations and direct customer support functions being made available through apps installable on customers’ smartphones and tablets.

TALANG's solution helps customers to manage their money, their way. Transactions such as mobile payments and transfers, ATM and branch location services, balance inquiry and payment-due reminders are some of the options made available on mobile. Mobile banking can benefit you with multiple advantages such as easy access, ample security and reliable applications. We aim on helping account holders have the best control over their money with our simplified banking solutions.

TALANGS has undertaken effective engagements in the Internal Services space that include PCI-DSS readiness assessment for leading banks in Europe, merchant monitoring solution for a well-known Nordics IT solutions provider, fraud prevention application for a foremost Nordics IT solutions provider, CRM platform for a leading Agriculture bank in the US, Risk Management solution for a key public sector bank in India, and financial management solution for a large service provider in the Nordics.

Our Internal Services offerings include:

- Risk Management & Compliance

TALANGS helps customers maintain processes according to the regulatory and statutory compliances applicable to the respective geography. Our extensive experience in the Mortgage Lending segment has helped clients to be compliant with the regulatory requirements such as Home Mortgage Disclosure Act (HMDA), Real Estate Settlement Procedures Act (RESPA), Truth in Lending Act (TILA), Equal Credit Opportunity Act (ECOA) and Fair Credit Reporting Act (FCRA). The payment solution we have developed strictly adheres to Single Euro Payments Area, which caters to both retail and corporate customers at one of the leading banks in the Nordic region.

TALANGS has been instrumental in developing a risk-based auditing system in compliance with the BASEL II accords and India’s Central bank’s directive. The biggest IT investments made in this space to develop innovative solutions towards risk management, with a simultaneous shift in the risk perspective, raises convenience to the enterprise level.

- Security

Financial fraud can take many forms, be it card-related fraud, real estate fraud, identity theft, money laundering, or good old swindling of gullible customers. The advancements in technology have given rise to increasingly dangerous and deceptive fraudulent techniques such as skimming, phishing, pharming, click jacking, and so on. The fact that online transactions, e-commerce and mobile commerce have exponentially grown in the last few years, has only attracted bigger number of fraudsters coming in with newer methods of attacks. Financial institutions have recognized this problem and are constantly striving to stay ahead of these fraudsters to ensure that their customers are guarded against such attacks and that they are able to confidently carry out their activities online or otherwise.

TALANGS offers proven industry solutions for a customer’s Card Services division, which engages in the production, distribution and implementation of cards and card-based systems. This includes merchant monitoring, card protector and authorization assistant modules catering to fraud monitoring from the acquiring and issuing bank, in close to real-time.

- CRM

CRM solutions have always been in demand in the Banking and Financial Services industry owing to the rich insights provided into consumer behavior. Knowing what the customers expect from banking services is of utmost importance to retain the business and their trust.

TALANGS provides what banks today are looking for in a CRM so that it can be implemented as a strategy to help make every customer contact optimal. This helps to improve the overall experience for customers, increase sales for the bank, and most importantly, go a long way in establishing a one-to-one relationship with every customer. The ever-expanding channel sophistication among customers has made this a very significant challenge indeed, and banks are seeking to deploy complex marketing strategies to be ‘always ready’, irrespective of the channel choice made by the customer.

- Financial Control

We help organizations to re-align their financial management and control functions. Shrinking operating margins and rising costs have resulted in organizations looking for complex and ultra-modern forecasting and budgeting solutions that would help them plan better for the future, while at the same time maintain profitability as well. Ever-increasing pressure from the government and regulatory bodies for transparent financial reporting has led to organizations seeking to implement very robust and reliable financial management and reporting solutions.

TALANG's services help with solutions required for gainful financial control and also scaling down the financial risks associated with banking systems. We enable the financial organizations to gain appropriate control and avail secure, reliable, and scalable technology services to its customers and end-users to run better business, distinctly.

TALANGS has been involved in delivering some high-end solutions to its customers in the Enterprise Services space. Our main solution deliveries include having offered customer analytics solution for a large bank in the USA, MDM solution for a vast IT solutions provider in the Nordics, sales analytics solution for a leading banking and investments provider in the USA, and CORE Banking and Payments MDM solution for a leading solutions provider in the Nordics.

TALANGS specializes in offering:

- Master Data Management

The aggregate MDM market has seen significant growth in the recent past and is expected to continue its northward journey in the coming years. The revenue streams are expected to materialize in terms of MDM packaged solutions, implementation services, and in the form of data services.

TALANG's core area of focus lies in ensuring data quality and accuracy as one of the key challenges for organizations in today’s environment that demands instant updates and up-to-date data. High-quality master data at the customer level, product level, employee level and enterprise level are some of the crucial success factors. Changing regulatory requirements are also bringing additional focus on having better MDM solutions. Organizations world over recognize this and huge investments in this direction have come forth in the recent past, which are expected to continue.

- Enterprise Content Management

TALANGS initiates Enterprise Content Management (ECM) solutions that facilitate business information management throughout the content lifecycle, right from creation to disposition. They provide the technology and frameworks to enable capture, manage, store, access and deliver content related to business processes. Information collation can take place from multiple sources including corporate email content, text and presentations, images, audio and video files, online resources such as websites, physical paper documents and so on.

The rapid growth of social media and extensive use of mobile interfaces has resulted in an unprecedented deluge of unstructured data as well. Corporations realize that they cannot afford to ignore this new source of data as it contains vital information about their customers, competitors and the industry. Hence, they are seeking solutions that can help them manage this inflow of data along with the effective use of digital media.

The banking and financial services industry has already recognized this and is constantly striving to set a number of mechanisms in place to make effective use of this rich information flow, and stay ahead among competitors.

- Customer Analytics

Customer analytics has today become the most important means for organizations to understand the pulse of the market and of its customers. The growth of the social media platforms means that, today, customers are extremely well connected and are using such forums to discuss and share their experiences, feedbacks and opinions.

TALANGS specializes in customer analytics that helps organizations to understand their customers’ thought patterns, which in turn help them predict customer behavior and tailor their products and offerings accordingly.